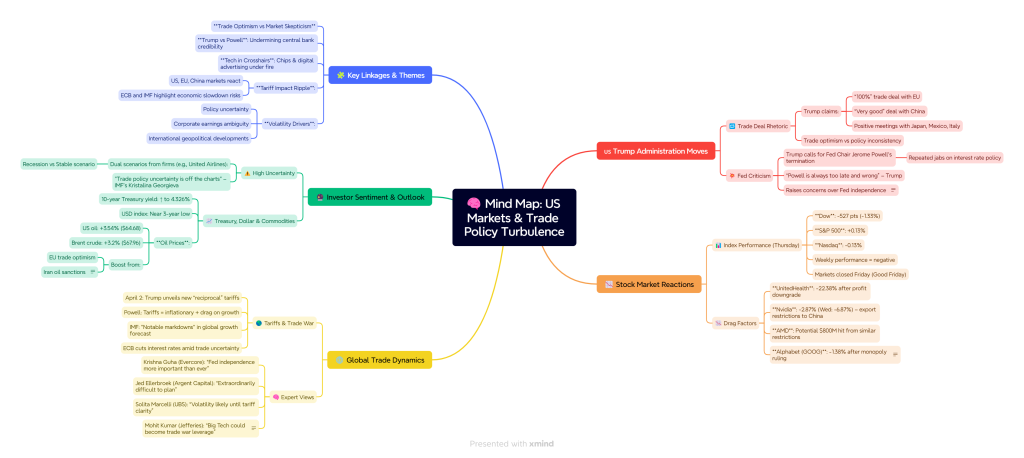

On Thursday, U.S. stocks showed mixed performance amid President Donald Trump’s conflicting signals on trade and Federal Reserve policy. While Trump expressed confidence in imminent trade deals with the EU and China, buoying markets, his renewed threats to fire Fed Chair Jerome Powell and criticism of interest rate policies initially caused volatility. Key highlights include:

- Market Performance:

- The Dow fell 1.33% (527 points), dragged down by UnitedHealth’s 22% plunge after cutting its profit forecast.

- The S&P 500 edged up 0.13%, while the Nasdaq dipped 0.13%.

- Markets closed the week lower, with trading halted Friday for Good Friday.

- Trade Deal Optimism:

- Trump asserted a “100%” likelihood of a trade deal with the EU and a “very good deal” with China, easing investor concerns temporarily.

- Trump vs. Powell Tension:

- Trump criticized Powell for not cutting rates faster, claiming his “termination cannot come fast enough.”

- Powell had warned that Trump’s tariffs risked inflation and economic slowdown, contributing to a prior market selloff (Dow dropped 700 points Wednesday).

- Economic Concerns:

- Analysts highlighted risks to Fed independence and inflation from Trump’s trade policies.

- Companies like United Airlines and chipmakers Nvidia/AMD faced uncertainty, with the latter citing billions in losses due to U.S.-China export restrictions.

- Global Context:

- The IMF signaled upcoming cuts to global growth forecasts, citing trade uncertainty and market volatility.

- The European Central Bank cut interest rates amid tariff-related economic threats.

- Oil prices rose 3-4% due to Iranian sanctions and trade deal hopes.

Key Takeaway: Market volatility reflected tensions between optimism over trade resolutions and concerns about Fed independence, tariff impacts, and geopolitical uncertainty. Investors remain cautious amid mixed signals from policymakers and corporate earnings.

Source: CNN